Protecting U.S. Bulk-Power System & Technology from Bad Actors: Part 2

On May 1, 2020, President Trump signed executive order “Securing the United States Bulk-Power System,” which was one of the most important executive orders to date, yet it was a blip on most people’s radar. In fact, there have been a string of key executive orders and bills put in place regarding the power supply and technology sectors to protect the U.S. from potential harm. While all eyes have been on 5G and Huawei, few seem to be paying attention to the bigger picture – electricity, solar, “climate change” agendas, manufactured parts, foreign interference and outsourcing – essentially, our entire powered infrastructure.

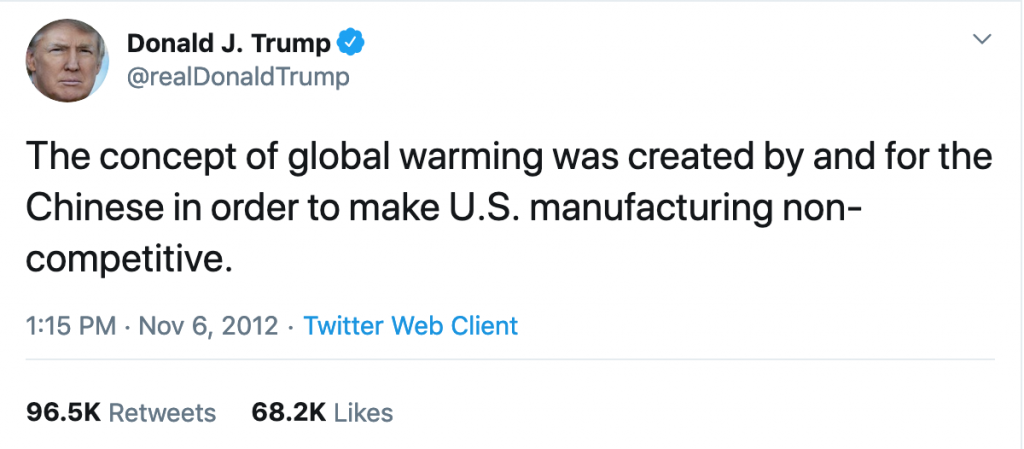

Part 1 of this report breaks down the timeline of key executive orders, bills, actions, and events that are critical to protecting the U.S., and reflects all the way back to 2012, showing where President Trump’s thought process was at long before he became president. It is essential reading to understand the magnitude of what is at stake and some of the protections that have been put in place.

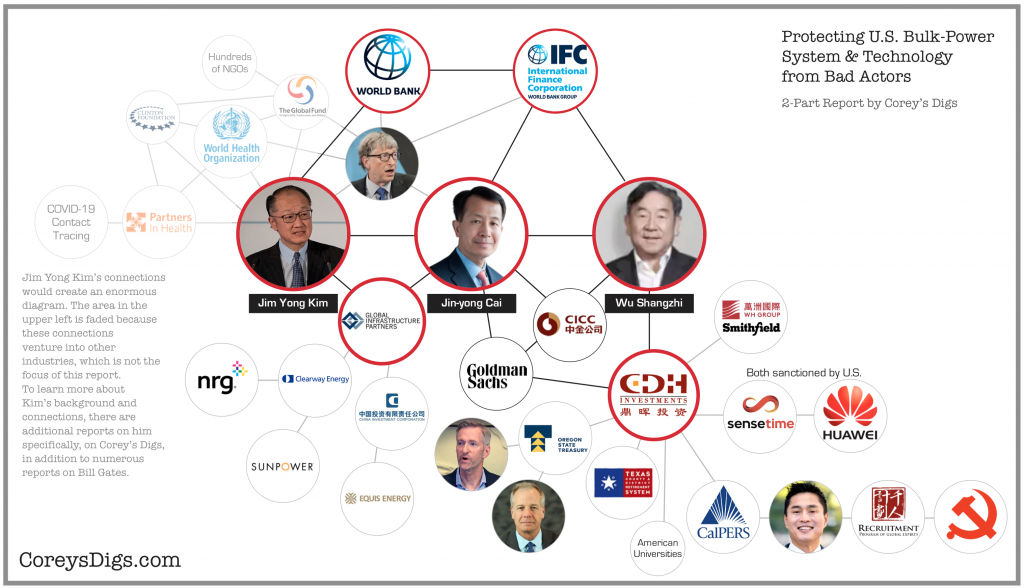

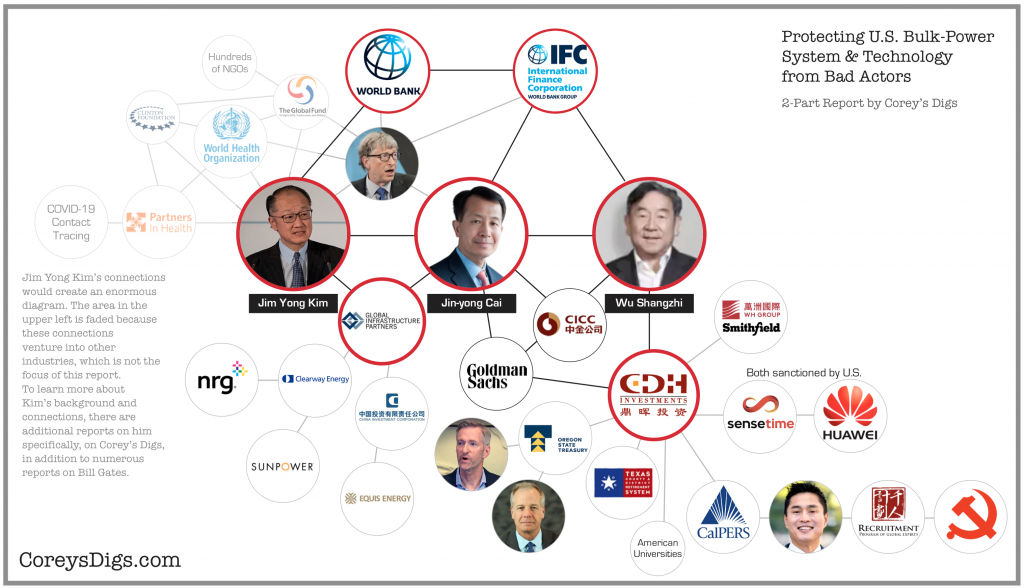

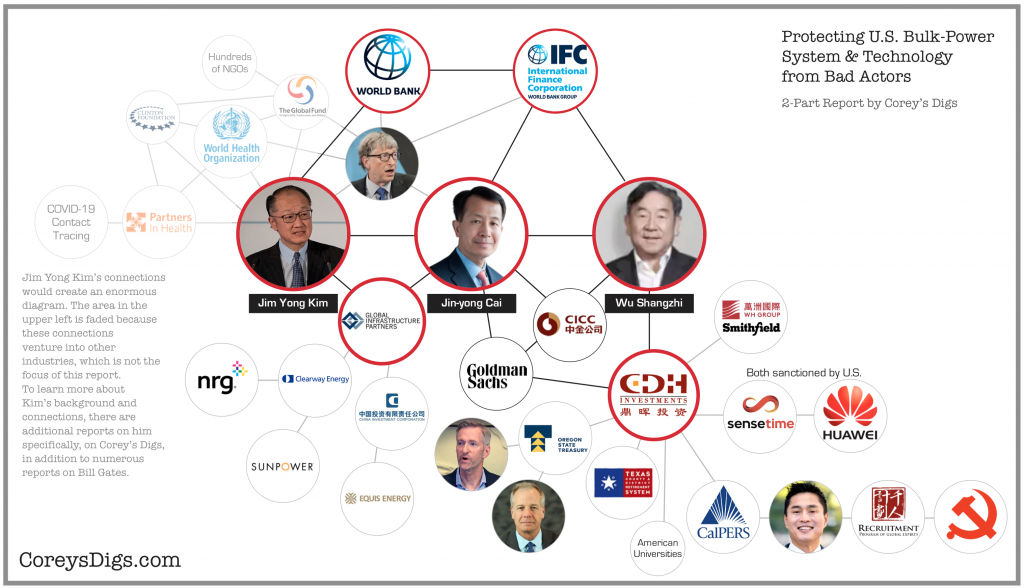

There are three individuals who have played vital roles in taking advantage of the U.S., running specific deals to benefit China, and focusing on monopolizing the energy and technology industries, among others, from high positions of financial authority, two of whom have flown under the radar with most people. This report exposes some of these endeavors.

Parts 1 & 2 of this 30-page report are also available in The Bookshop in a single pdf download.

Three Key Players Flying Under The Radar

Corey’s Digs has reported extensively on former World Bank President Jim Yong Kim, his ties to Dartmouth, HIV/AIDS slush fund, Bill Gates and the Clintons, the World Health Organization, and recent involvement with COVID-19 contact tracing. This report covers another industry he is heavily involved in, along with two other individuals that no one is talking about, both of whom were born in China.

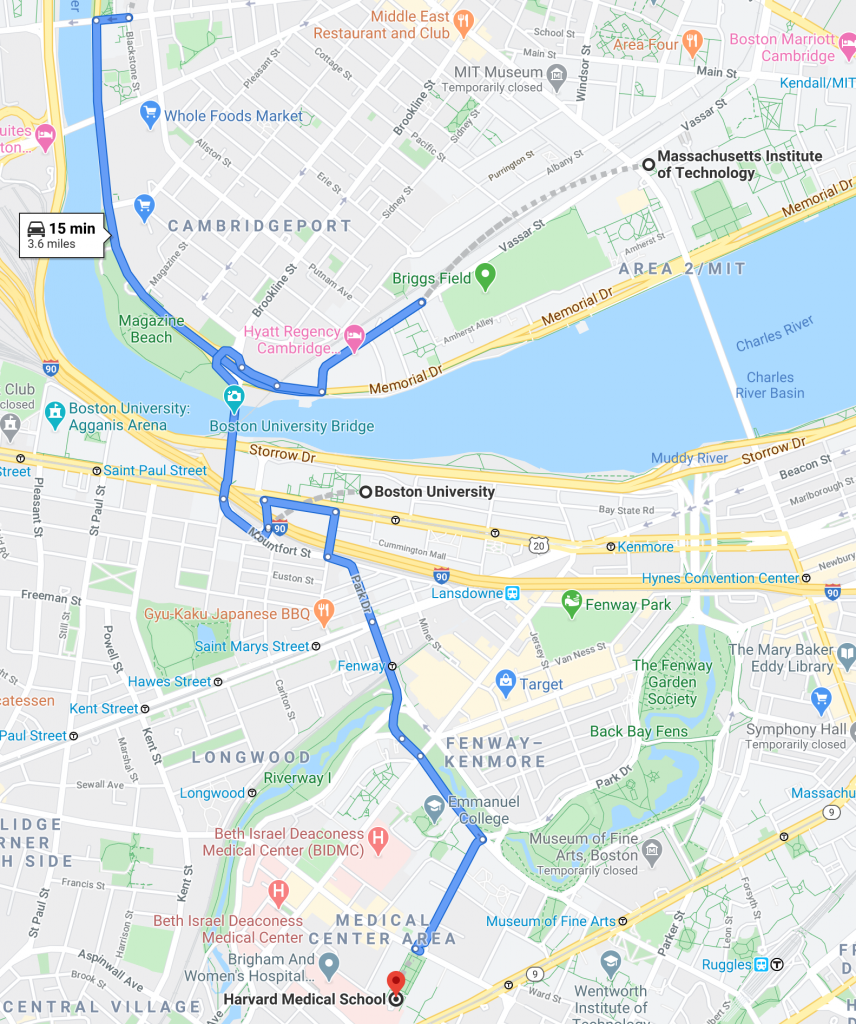

Coincidentally, all of these men graduated high profile schools within a 4-mile radius of one another, and all within six years of each other, who went on to work for the World Bank with overlapping timeframes. But there are a lot more coincidences documented below.

Wu Shangzhi graduated MIT with a PhD in mechanical engineering in 1985

Jin-Yong Cai graduated Boston University with a PhD in economics in 1990

Jim Yong Kim graduated Harvard Medical School with an M.D. in 1991, and PhD in anthropology from Harvard University in 1993

Partners in Health was formed in 1987 by Jim Yong Kim, along with four co-founders, including Paul Farmer who graduated Harvard University in 1990. Kim and Farmer are at the forefront of the contact tracing agenda for COVID-19, both having deep ties to the Clintons and Bill Gates.

It should be noted that Bill Gates funds all of those schools, in addition to other schools they have attended as well, including those in China.

Wu Shangzhi, Jin-Yong Cai, and Jim Yong Kim all formerly worked for the World Bank in high-ranking positions, with overlapping time frames.

Wu Shangzhi

1984-1991 – Operation Officer at the World Bank specializing in investment projects for China and India

1991-1993 – Senior Investment Officer at the International Finance Corporation of the World Bank Group

Jin-Yong Cai

1990-1993 – Economist in Central Europe and South Asia for the World Bank

2012-2015 – CEO of the International Finance Corporation of the World Bank Group

Jim Yong Kim

2012-2019 – President of the World Bank

Both Jim Yong Kim and Jin-Yong Cai currently work for Global Infrastructure Partners (GIP). They began working with GIP just three months apart.

• Jim Yong Kim began on February 1, 2019 after resigning from the World Bank.

• Jin-Yong Cai began in May, 2019 after departing TGP Capital.

Both Jin-Yong Cai and Wu Shangzhi played instrumental roles in the founding of China International Capital Corporation (CICC) in 1995, the first ever investment banking venture in China, which played a critical role in the Chinese economic transformation. More on this further down.

• Jin-Yong Cai was the Managing Director to the China International Capital Corporation (CICC) at its inception.

• Wu Shangzhi was the head of CICC’s private equity group from its inception.

Both Jim Yong Kim and Jin-Yong Cai have decades-long ties to Bill Gates, as well as funding his endeavors while they worked for the World Bank. Gates also has very strong ties to the technology, energy, and climate sectors, as well as to China.

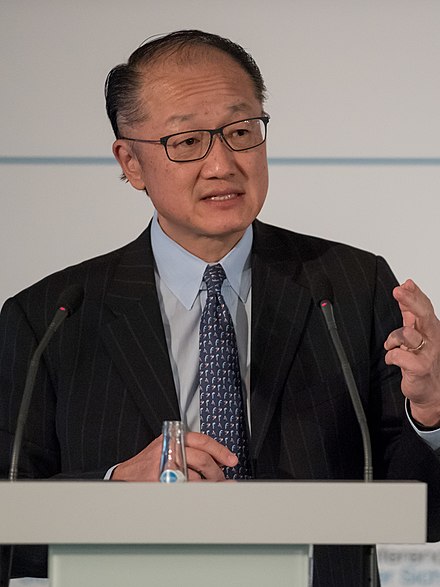

JIM YONG KIM: Former World Bank President and Current GlP partner

• Born in South Korea, raised in the U.S. where he currently resides

• 1983 – Co-founded Partners in Health in Zanmi Lasante in Cange, Haiti

• 1987 – Co-founded Partners in Health in the U.S.

• 1991 – Graduated Harvard Medical School with an M.D.

• 1993 – Graduated Harvard University with a PhD in anthropology

• 2003 – Advisor to Director-General World Health Organization and Director of HIV/AIDS Dept.

• 2006-2009 – Various positions affiliated with Harvard

• 2009-2012 – President of Dartmouth College

• 2012-2019 – President of the World Bank

• 2019 – Partner at Global Infrastructure Partners

• Kim has received the MacArthur “Genius” Fellowship, was recognized as one of America’s “25 Best Leaders” by U.S. News & World Report, and was named TIME magazine’s “100 Most Influential People in The World.”

In January 2019, Kim resigned from the World Bank three years early, after a 7-year stint, being appointed by former President Barack Obama, and selected by none other than Hillary Clinton. This was a very significant position to just walk away from, so there had to be irons in the fire to carry out far greater agendas that he was no longer able to carry out through the World Bank. On February 1, 2019, he became a partner at Global Infrastructure Partners (GIP) based out of New York. They are a large equity investment firm, investing in the energy sector, ports, infrastructure, and transportation. (More on GIP below.) While those endeavors continue, he is also working with his co-founders of Partners in Health, Ophelia Dahl and Paul Farmer on implementing COVID-19 contact tracing surveillance in multiple states. You can read much more about Kim’s history in other reports by Corey’s Digs, in addition to his decades-long work with the Clintons and Bill Gates.

Kim also has long-standing relationships with Dr. Anthony Fauci and Deborah Birx, as they have all been involved in the HIV/AIDS agenda, going back decades. In fact, they even produced a movie titled ‘Bending The Arc’ which tells the story of Partners in Health changing global health, and had both Fauci and Birx at the screening and as panelists, in 2018. The panel discussion entailed talks about how they would “bolster leadership and investment to conquer pressing global threats like famine, refugee crises, and pandemic disease.”

During Kim’s time at the World Bank, they financially supported three urban transport projects in the Wuhan China metropolitan region, with $120 million funded in February 2016 alone. Well before Kim’s time at the World Bank, in 1999 the IFC had invested $11.5 million for China Infrastructure’s Wuhan International Container Transshipment project.

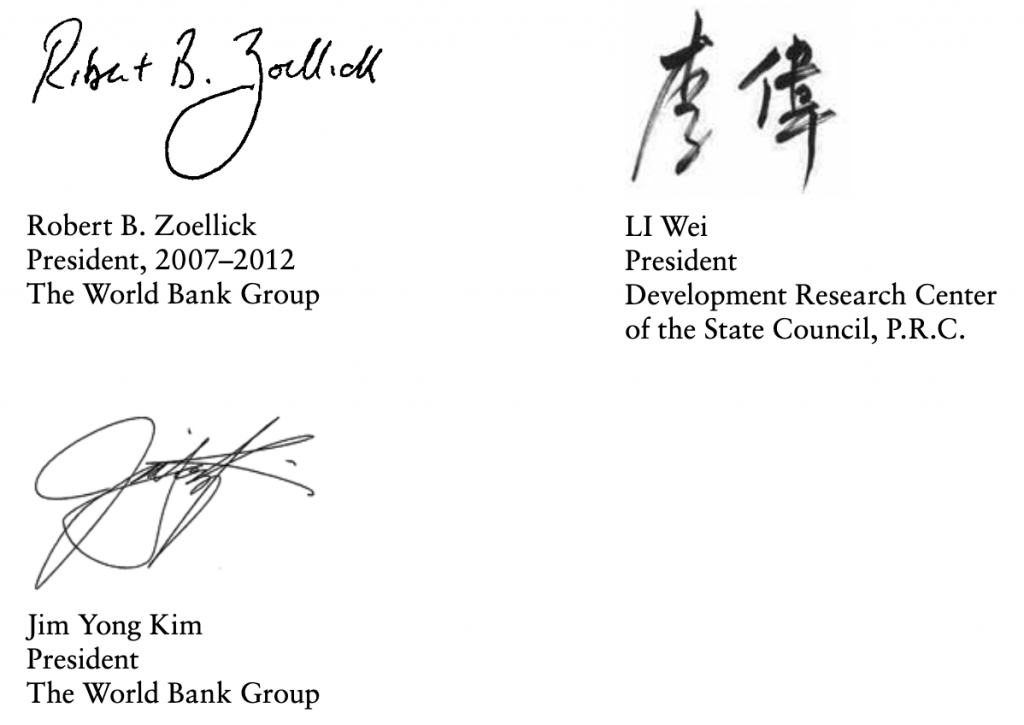

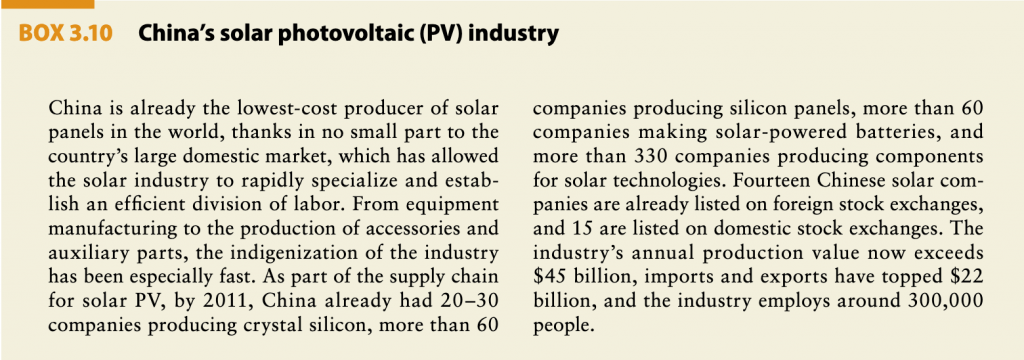

In 2012, Kim’s predecessor Robert Zoellick, who now serves on the board of directors for Twitter, (I know, it’s difficult to keep up with all of these shenanigans), had worked diligently on the ‘China 2030’ report on ‘Building a Modern, Harmonious, and Creative Society’ by the World Bank and the Development Research Center of the State Council, Beijing’s cabinet, which is a 470-page blueprint for China’s transition from an export-driven economy to a consumer-led one.

The report is packed full of information, data, and ranking comparisons between countries, especially with the United States, and includes China’s lead in several areas of the energy industry. By 2012, China had become the world’s largest manufacturer, largest exporter, and second-largest economy.

Remember this tweet from 2012, four years prior to Donald Trump becoming President, along with the 30% tariffs he imposed on solar panels abroad in 2018?

One of Kim’s top aides was Jin-Yong Cai, the VP and CEO of World Bank Group’s IFC, at the time. They forged quite a relationship, got into a bit of hot water, and a few years later both became partners at Global Infrastructure Partners. (more on that below).

JIN-YONG CAI: Former VP and CEO of World Bank Group’s IFC

• Born in China, and has worked in both the U.S. and China

• 1982 – Science degree from Peking University

• 1990 – PhD in economics from Boston University

• 1990-1993 – Economist in Central Europe and South Asia for the World Bank

• 1994 – Joined Morgan Stanley and was also the Managing Director of the China International Capital Corporation (CICC) which launched in 1995

• 2000-2012 – Participating Managing Director in Goldman Sachs Group and Chief Executive of Goldman Sachs Gao Hua in China

• 2012-2015 – Executive Vice President and CEO of the International Finance Corporation (IFC) of the World Bank Group, as one of Jim Yong Kim’s top aides.

• 2016-2019 – Partner of Texas Pacific Group (TPG) Capital, based in Hong Kong

• 2019 – Partner at Global Infrastructure Partners headquartered in New York

• Has served on the board of Aon, Policy Commission of the Asia Society Policy Institute, the International Advisory Board of King Abdullah Petroleum Studies and Research Center, and the International Advisory Board for Blavatnik School of Government and the University of Oxford

Two days after Jin-Yong Cai started his job at the IFC of the World Bank Group, he announced that they will further expand their business in Africa. Cai said in Dakar that “IFC will leverage its leading innovative global platform for investments, advisory services, and investment mobilization to do more in the world’s poorest countries and fragile states.” He went on to state that “A long-term strategic commitment to Sub-Saharan Africa has allowed IFC to become the leading international financial institution promoting private sector investment. IFC’s global expertise, local presence, and products and services are meeting the needs of African private businesses today.”

Cai’s focus was on “Encouraging private investments in energy, infrastructure, and other areas is an important way that IFC can help Senegal fill basic needs.” One month after his first meeting in Africa, Bill Gates funded the IFC $614,708 for sanitation in Kenya and East Africa.

For years, Jin-Yong Cai worked with the Bill & Melinda Gates Foundation, while Gates stuffed the IFC with millions. Who’s running the show, where are the funds really going, and how involved was China in all of this, being as Cai’s background is in investment banking in Asia and Bill Gates investments and focus has always been on Africa and South East Asia?

In April 2013, the IFC and Bill & Melinda Gates Foundation hosted an event calling on the private sector to deepen its impact on ending extreme poverty by 2030. Both Jin-Yong Cai and Jim Yong Kim were in attendance and strategized this goal with Gates.

According to a 2015 report on ‘Financing African Infrastructure’ by the Global Economy and Development at Brookings, “In 2014, the city of Dakar, with technical assistance from the Gates Foundation, plans to issue the first non-sovereign-backed municipal bond in all of sub-Saharan Africa outside of South Africa. The $41.8 million bond will be backed by a guarantee from the USAID Development Credit Authority. This will raise funds for the construction of a marketplace for more than 3,500 street vendors.”

The report goes on to review investments in infrastructure and major power and rail projects in Africa, concluding that if their more recent estimates are accurate based on prior years, China is clearly the main source for infrastructure financing in sub-Saharan Africa outside of national budgets.

Bill Gates doesn’t hide the fact that he “partners with China for global development.” According to Gates, “China has become Africa’s largest economic partner.” In fact, Gates tax returns indicate 34 million shares in China’s Everbright International Limited who focuses on energy, water, and environment in Africa and other countries.

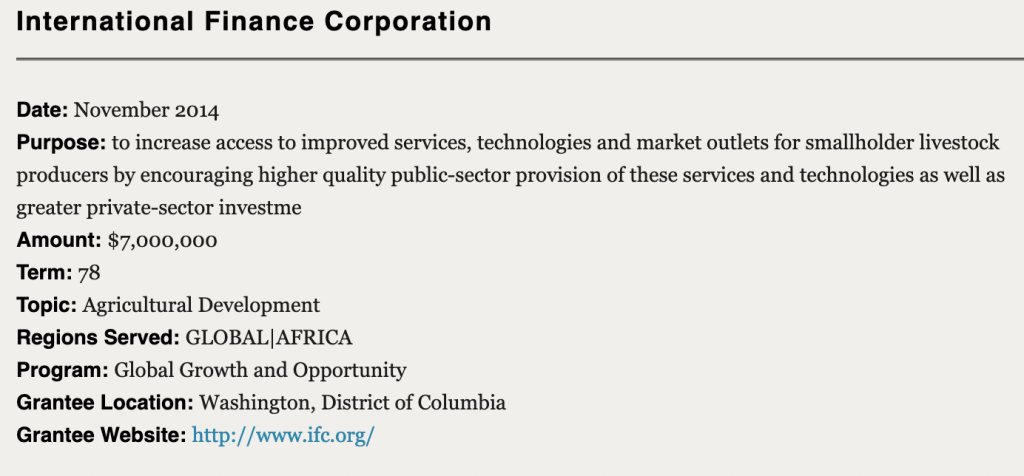

During Jin-Yong Cai’s time at the IFC, between 2012-2015, Gates was incredibly generous with grants to develop Africa, alongside his China partners.

In 2013, he funded the IFC $3.2 million to create a roadmap for a computer system in Tanzania.

In 2014, another $3.9 million to IFC to increase access to technologies and smallholder livestock producers in Africa.

In 2014 he funded the IFC another $7 million specifically for agricultural development in Africa.

In February 2015, Gates funded the IFC nearly $10 million to digitize the health payment system in Bihar in east India and Uttar Pradesh in northern India.

In 2016 and 2017 funding from the Bill & Melinda Gates Foundation totally stopped to the IFC, despite having funded them year after year consecutively during Cai’s time as CEO. Then, in 2018 there was one final grant to the IFC in the amount of $5 million to strengthen India’s smallholder farmers.

Jin-Yong Cai Submitted his Resignation in 2015 After Coming Under Fire

In 2013, The World Bank made $1.65 billion in loan commitments in China, and its private sector arm, the International Finance Corp (IFC) committed $1.64 billion, both while Jim Yong Kim and Jin-Yong Cai were in charge.

In November 2015, Jin-Yong Cai and Bertrand Badré, two of Jim Yong Kim’s top aides, both submitted their resignations after coming under fire earlier that year for an unusual $1 billion loan from China. As reported by The Epoch Times, Badré and Cai worked on the loan from China that allowed China to increase its lending through the International Development Association (IDA). The Financial Times reported that there was unease among shareholders due to Cai’s aggressive investments, particularly to Chinese companies. As of 2015, the IFC had invested more than $10 billion in over 300 projects with China since 1985.

Just two weeks after the investigation probe began into the $1 billion loan, it was quickly dismissed by Locke Lord Edwards law firm, finding no wrongdoing. Despite the Bank’s treasurer Madelyn Antoncic first raising questions about the handling of the loan in December 2013, Jim Yong Kim did not initiate the review until February 2015.

Cai went on to become partner of Texas Pacific Group (TPG) Capital, based in Hong Kong, and three years later left to become a partner at Global Infrastructure Partners (GIP), headquartered in New York – just three months after Jim Yong Kim became a partner at GIP.

Cai’s history with Wu Shangzhi, former senior investment officer at the World Bank Group’s IFC, dates back to 1995, and likely long before. Together, they played instrumental roles in the founding of China International Capital Corporation (CICC), the first ever investment banking venture in China. More on this below.

WU SHANGZHI: Former Senior Investment Officer at the World Bank Group’s IFC

• Born in Beijing, China, has worked in both the U.S. and China, and currently resides in China

• 1985 – Graduated MIT with a PhD in mechanical engineering

• 1984-1991 – Operation Officer at the World Bank specializing in investment projects for China and India

• 1991-1993 – Senior Investment Officer at the International Finance Corporation of the World Bank Group

• Returned to China

• 1992 – began working on CICC

• 1995 – Head of CICC’s private equity group since its inception

• 2002 – Established CDH Venture with six founding partners

Not many people will be familiar with Shangzhi, however, his connections and investments are quite substantial. From the World Bank and IFC to CICC and CDH, he’s been instrumental in several sectors. Whereas some of his endeavors have little to do with energy power sources, they are very significant ventures with key connections and indicate a long-term plan.

Shangzhi served five years for the World Bank, specializing in investment projects for China and India, followed by two years as a senior investment officer at the IFC arm of the World Bank. While there, he decided to establish an investment firm in China, and approached GIC Private Limited, Singapore’s sovereign wealth fund, which was created in 1981 under the advice of British merchant bank N M Rothschild & Sons. GIC suggested that Shangzhi join China International Capital Corporation (CICC), an investment bank that GIC was involved with. The CICC was incorporated by China Construction Bank, Morgan Stanley, China National Investment and Guaranty Co Ltd, GIC, and the Mingly Corporation. Shangzhi went on to lead until it was split off in 2001 because the China Securities Regulatory Commission prohibited investment banks from doing private equity investments.

During that time, between 1990 and 1993, Jin-Yong Cai was an economist in Central Europe and South Asia for the World Bank, and joined Morgan Stanley in 1994 while working with Shangzhi to develop the CICC, which officially launched in 1995. Cai became the head of CICC’s private equity group, then went on to work for Goldman Sachs from 2000-2012. The CICC was the first ever investment banking venture in China, which played a critical role in the Chinese economic transformation.

CDH Spin-off from CICC in 2002

Wu Shangzhi created a spin-off from CICC in 2002, along with Jiao Shuge and four other investment professionals. Their investors come from big companies, such as CICC, Morgan Stanley, Dow Chemical Company, McKinsey & Co, Arthur Andersen. As a leading investment fund manager focused on China, they manage over $21 billion in assets, have invested in more than 200 companies and helped over 70 companies list on the international and China’s domestic stock exchanges. They invest in several sectors, including; retail and consumer, industrial manufacturing, financial, high-tech services, medical, and real estate.

CDH, Oregon State Treasury, California Public Employees’ Retirement System and American Universities

In 2014 Chinese firm CDH closed its last flagship private-equity fund at a $2.5 billion hard cap. Some of the large U.S. investors were Oregon State Treasury, the California Public Employees’ Retirement System and the Texas County & District Retirement System. In 2014, Mayor Ted Wheeler of Portland Oregon, was the State Treasurer, and Chief Investment Officer John Skjervem of seven+ years just resigned on March 31, 2020.

The Chief Investment Officer, Yu Ben Meng, of California Public Employees’ Retirement System (CalPERS) resigned on August 5, 2020, months after reports came out that the fund invested $3.1 billion in Chinese companies, some of which have been blacklisted by the U.S. government. Meng had been recruited to his position by the Chinese Communist Party through the Thousand Talents Program. Secretary of State Mike Pompeo accused the fund of investing in firms that supply the Chinese military.

In 2017, WSJ reported that CDH was looking to raise $2 billion to invest in Chinese companies. “An uptick in appetite for Asian buyouts has fueled a fundraising boom in the region this year. Buyout houses focused on investing in China have raised a record $9.4 billion in 2017, according to Preqin Ltd. Firms raising capital to do deals across Asia have collected $24.5 billion, on pace to surpass a $24.8 billion record set in 2014.”

According to CalPERS 2018 performance report, they also have investments with Global Infrastructure Partners, where Jim Yong Kim and Jin-Yong Cai are both partners.

American universities have also invested in CDH. At a CDH convention, Shangzhi was asked why they are bothering with other services since they have already succeeded in private equity. “CDH’s total assets management is driven by the demand of the investors. Investors, especially the donation fund from American universities hoped to cooperate fully with an institution with rich experience, fine culture and risk control. They invested in our venture capital) and private equity, and endowed us with qualified foreign institutional investor (QFII). If there are no demands from the investors, i.e., no funds from them, things like this would not happen,” Shangzhi responded.

CDH Owns Smithfield Foods – The Largest Pork Producer in The World

Wu Shangzhi’s CDH and Goldman Sachs invested $256 million in a controlling stake in the Chinese largest pork producer, Shaunaghui Group. In 2009, Goldman sold its stake back to CDH for five times what it paid. Coincidentally, in 2009 CDH was raising $1.4 billion for a private equity fund targeting growth-stage companies in China. It was backed by Singapore’s GIC and the World Bank’s IFC, where both Shangzhi and Cai both worked for years.

Fast forward to 2013, when Shaunaghui, now called WH Group, purchased Smithfield Foods, the largest pork producer in the U.S., making them the largest pork producer in the world.

Smithfield Foods had previously acquired Premium Standard Farms in Princeton, Missouri, farmland that was part of the Shaunaghui-Smithfield deal. How did they accomplish this when Missouri law banned all foreign ownership of land? Just one week prior to the purchase, the Missouri legislature amended the law to allow for 1% of Missouri farmland to be owned by foreign interests (roughly 289,000 acres), which cleared the way for approval. This allowed them to acquire more than 40,000 acres of Missouri farmland. Was there pay to play or kickbacks for these legislatures that pulled this off just one week prior to the sale?

Ironically, during the China coronavirus impacting the U.S., Smithfield Foods was one of the major meat producers closing up shop, and the Missouri location was sued by an advocacy group.

As of May 2020, CDH Real Estate Funds are managing 30 assets located across 14 states and 23 cities in the US.

This is a screenshot taken from their real estate page.

According to the USDA’s Economic Research Service, Chinese investment in the agricultural sector has grown tenfold between 2009-2016. China has been buying up land in the U.S. for quite some time, as have other foreign investors, and CDH’s WH Group (Smithfield) owns about 150,000 acres alone. In Ohio, foreigners have bought up a half million acres.

CDH and U.S.-Sanctioned SenseTime Partnered to Co-manage an AI Fund in 2017

CDH and SenseTime set out to raise roughly $453 million to invest in firms working on AI technology. SenseTime provides technology-based applications for facial recognition, video analyzing and autonomous driving, with major clients such as Huawei Technologies, China Mobile, and HNA Group. They operate large supercomputers in Chinese cities that handle its facial recognition software.

In October, 2019 the U.S. Commerce Department had placed 28 Chinese public security bureaus and companies on its “Entity List” to block them from doing business with American companies. SenseTime was on this list, which came after the sanction on Huawei due to national security. “Specifically, these entities have been implicated in human rights violations and abuses in the implementation of China’s campaign of repression, mass arbitrary detention, and high-technology surveillance against Uighurs, Kazakhs, and other members of Muslim minority groups,” the U.S. Commerce Department said.

Side note: The Bill & Melinda Gates Foundation Trust held over $50 million in China Mobile common stocks, according to their 2018 tax filing. They also held over $10 million in Hangzhou Hikvision Digital common stock, which is one of the sanctioned Chinese companies that is a large security camera maker and utilizes US-made features in their cameras, including pre-installed Microsoft Windows 10.

These are but a few examples of the Chinese company’s investments and reach.

Who is Global Infrastructure Partners (GIP) Where Fmr World Bank President & Fmr Director of the IFC Are Currently Partners At?

An infrastructure investment fund founded in 2006, GIP is headquartered in New York City, with a focus on infrastructure assets in the energy, transportation, ports, and water/waste sectors. It operates as a partnership consisting of 22 partners, with five being founding partners. They are currently one of the largest clean energy companies in the United States due to acquisitions.

When Jim Yong Kim resigned from the World Bank in 2019, three years before his term was up, he went on to become a partner. Likewise, just three months later, his former aide and head of the World Bank’s Arm International Finance Corporation Jin-Yong Cai also became a partner at GIP after a 2-year stint at Texas Pacific Group (TPG) Capital, who has also partnered with CDH.

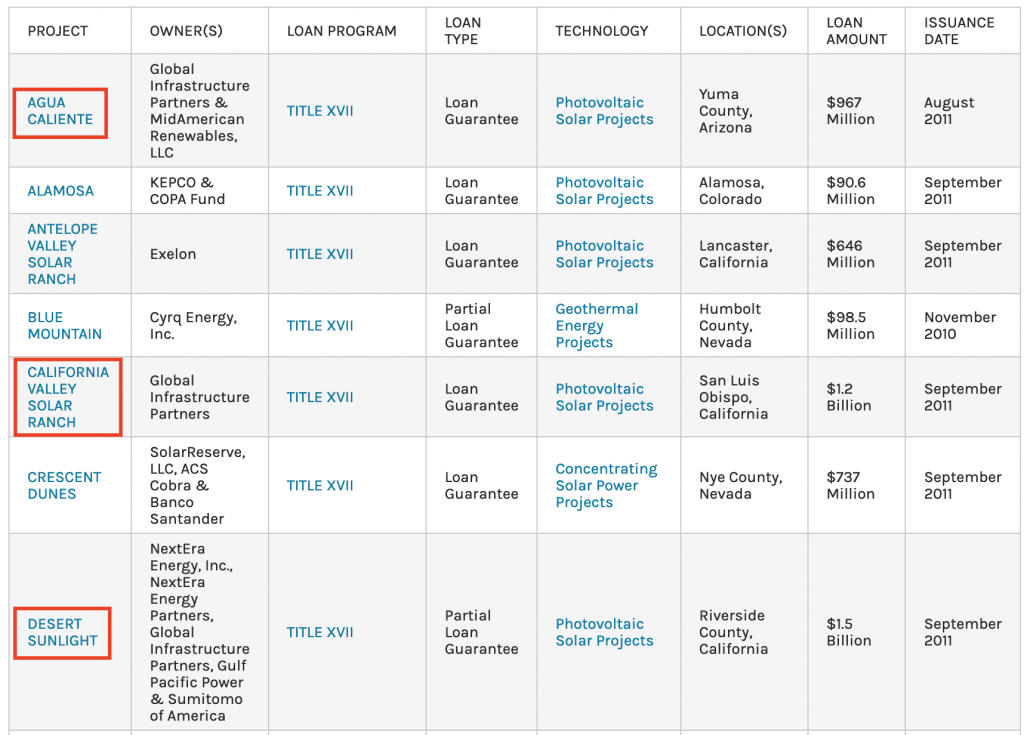

Obama Administration’s DOE Contracted with GIP

2011 marked a big year for the Obama administration dumping billions in loans into the “clean energy” sector. Three of those were designated to projects owned by Global Infrastructure Partners. These took place just months before Jim Yong Kim was appointed to World Bank President.

August 2011 – Agua Caliente project in Yuma County, AZ – $967 million

September 2011 – California Valley Solar Ranch project – $1.2 billion

September 2011 – Desert Sunlight project in Riverside County, CA – $1.5

A lot was happening in 2011 and 2012 around Obama’s big “solar project” government loan guarantees. President Trump’s Department of Energy just recently recovered $200 million in taxpayer funds from a 2011 $737 million loan by the Obama administration to Tonopah Solar Energy to finance the $1.1 billion Crescent Dunes Solar Energy Project in Nevada that was deemed obsolete before it went online. These funds were distributed just three weeks after Solyndra received $535 million from the Obama administration, just prior to filing for bankruptcy.

In 2012, the heat was turned up again, when Jim Jordan (R-Ohio), subcommittee chairman of the Committee on Government Oversight and Reform, summoned executives of solar and geothermal companies that received stimulus money, and alleged that BrightSource won its loan guarantee based on its close relationship with the DOE and Obama administration. There were emails of concern, and the former chairman of BrightSource, John Bryson, had become Obama’s Secretary of Commerce. There were also concerns over First Solar’s chairman Michael Ahearn selling $450 million in shares over a three-day period.

Coincidentally, VP of Development Patrick Sullivan, joined Clearway Energy, owned by Global Infrastructure Partners, in 2013, after working as the Senior Director of Business Development for BrightSource Energy.

GIP Acquisitions and Investments

Acquired NRG Energy Inc.’s Renewable Energy Business in 2018

• Also includes controlling stake and 46% economic interest in NRG Yield, Inc. which is diversified across wind, solar, natural gas technologies, and owns thermal infrastructure assets with electric generation servicing businesses, universities, hospitals, and government customers

• Also includes O&M and development businesses which operates renewable power generation in 17 states

• Owns and operates the largest portion of Alta Wind Energy Centre in Kern County, California, which is one of the world largest wind farms.

• NRG has partnered with the Clinton Foundation to provide solar energy to Haiti, among other projects, as well as developing a microgrid on Necker Island with Richard Branson’s company, Virgin Limited Edition

NRG was Renamed to Clearway Energy Inc.

• Clearway Energy Inc.’s portfolio includes 7,000 megawatts of wind, solar, and natural gas-fired power generation facilities across North America

• Its parent organization, Clearway Energy Group, has solar and wind energy assets in 25 states, with a development pipeline across the country

• In September 2018, Clearway Acquired SunPower, with a solar pipeline consisting of 4.7 gigawatt utility-scale solar development spanning 16 states. One year later, they earned a Chinese invention patent for their shingled solar cell manufacturing method. Their Performance Series panels are “the most deployed shingled cell solar panels in the world,” and were named a “top performer” by DNV GL, an independent energy expert and certification body. DNV GL is partnered with the Clinton Foundation, Richard Branson, and others in the Ten Island Pilot Program that Corey’s Digs reported on in 2018.

• Some subsidiaries include: Buckthorn Renewables LLC, Rattlesnake Flat LLC, Somerset Wind LLC, Greenmountain Wind LLC

• Coincidentally, VP of Development Patrick Sullivan, joined Clearway in 2013, just one year after the DOE/BrightSource alleged scandal broke, after working as the Senior Director of Business Development for BrightSource Energy

GIP Partnered with China Investment Corp to Acquire Equis Energy in 2018

• Asia’s largest independent renewable energy power producer in Asia-Pacific with over 180 assets in solar, wind, and hydro generation across Australia, Japan, India and the Philippines

• It was the largest renewable energy generation acquisition in history

• GIP holds a 50% stake, CIC between 10-20%, and the Public Sector Pension Investment Board of Canada also owns a 10-20% stake

GIP purchased 35% of Mediterranean Shipping Company’s (MSC) terminal division, Terminal Investment Limited SA (TIL) in 2013

• TIL invests in, develops and manages container terminals around the world, with material ownership interests in 37 terminals in 26 countries

GIP has investments in multiple ports across the world, as well as a few airports. All of the above is a mere snapshot of some of GIP’s bigger acquisitions and investments, primarily in the energy sector.

Protecting Our Bulk-Power System and Technology from Bad Actors

If you think “nothing is happening,” you couldn’t be more wrong. There are a lot of moving parts happening behind the scenes, and when smaller pieces of the puzzle are released, many don’t connect the dots to see the bigger picture. Most people are focused on indictments and justice – rightfully so – however, there are critical actions being made in regards to our national security, the daily activities we all carry out, and protections put in place on a grander scale.

When reviewing the timeline of these actions, it is clear that President Trump publicly expressed these concerns as far back as 2012, long before he was president. Our power grid, electricity generation, renewables, manufactured parts, and technology, are the very things that allow us to thrive and survive. Without power, it would obviously be disastrous, upsetting our entire infrastructure and putting lives at risk.

Investments in electricity production from renewable energy exceeds $250 billion annually, with China leading the way. They helped create the fear of “climate change” to monopolize this industry and the manufacturing of parts to be sold to the U.S., while the Obama administration, Clintons, and others pushed for loans, grants, and legislation that helped China with this endeavor. U.S. pension funds and universities are investing in China, while China buys up land and the biggest pork producer in the U.S. When we look at just a few of those involved and see their nefarious connections, and their ties dating back to the World Bank and IFC, and observe the plays being made, one can understand the concerns over these power grabs and the need to lock it down, which the Trump administration has been doing while everyone has been distracted by Spygate and COVID.

Download this full 2-part report in pdf format in The Bookshop >>>

4 Comments

Lani

Please note that there are 2 versions of 5G

Basing this comment on recent posts.

The china version and another that doesn’t use the 60hz invasion that effects oxygen in the body.

Much to my relief.

Nikki

Wow!

Good job Corey Lyn.

Deep, Dark, Dangerous.

You are revealing the tentacles of the Cracken.

Ali

Corey, you just blow my mind. Your sleuthing abilities are spectacular! Thank you, thank you!

technology

First up on Top 10 technology trends list we have 5G technology, now 5G is the next generation of cellular networks and services. Currently, the market is led by Switzerland and closely followed by South Korea and the US.

https://fukatsoft.com/b/top-10-new-technology-trends-for-2021/