Latest Victims of Debanking Trend: Dr. Mercola & Associates

By Corey Lynn and The Sharp Edge

A steady descent into financial tyranny is taking place one step at a time, as major banks continue to target customers based on their beliefs. JPMorgan Chase is listed among a host of financial institutions as “high risk” for cancelling or denying services based on views or beliefs, according to a nonprofit organization dedicated to protecting consumers and businesses from woke capitalism.

The latest victims of this debanking trend are Dr. Mercola, his business associates, and their family members. The following excerpt of Dr. Mercola’s article titled “Chase Shuts Down Bank Accounts of Mercola and Key Employees,” outlines the cancellations of personal and business accounts by JPMorgan Chase with little to no explanation provided.

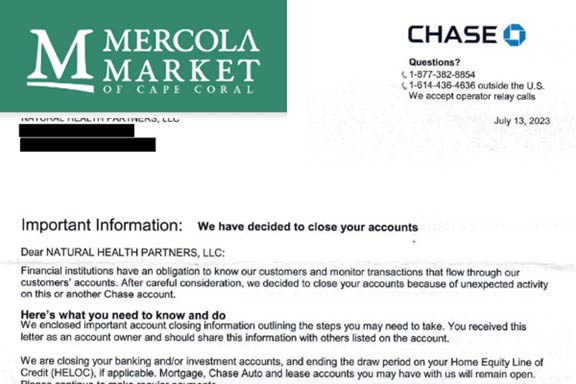

“July 13, 2023, JPMorgan Chase Bank suddenly informed me they are closing all of my business accounts, both banking and investment accounts, along with the personal accounts of my CEO, my CFO and their respective spouses and children.

No reason for the decision was given, other than there was ‘unexpected activity’ on an unspecified account. The oldest of these accounts has been active for 18 years.

Politically-Motivated Harassment

This is what the new social credit system looks like, and what every soul on the planet can expect from the central bank digital currencies (CBDCs) that are being rolled out. Go against the prevailing narrative of the day, and your financial life will be deleted with the push of a button.

It’s difficult enough trying to navigate this hurdle today. Once everything is digitized, cash eradicated and the social credit system completely integrated and automated, this kind of retaliatory action for wrongthink could be a death sentence for some people.

My CFO, Amalia Legaspi, whose Chase accounts — including a joint account with her husband — were closed along with mine, is now struggling to figure out how to pay for her husband’s health care in the Philippines. He’s bedridden with dementia and is wholly dependent on her financial support, and she’s not allowed to open another bank account in his name.

‘I have to provide all the legal documentations including notarized physicians’ affidavit from the Philippines to prove that my husband is incapable of handling his finances and request the Federal to directly deposit the pension to my own personal account,’ Legaspi told Florida’s Voice.

Legaspi’s son’s account — which he’s using to pay for college expenses — was also cancelled. My CEO, Steven Rye, believes his and his wife’s accounts were shut down because of my opinions on COVID-19. He told Florida’s Voice:

‘I believe they cancelled all of the accounts because of Dr. Mercola’s (our employer) opinions. He has carried a contradictory view throughout the COVID narrative and co-authored the best-selling book ‘The Truth About COVID-19,’ which exposed the likelihood that this virus was engineered in a laboratory funded by the NIH.’

In May 2023, Florida Gov. Ron DeSantis signed legislation specifically prohibiting financial institutions from denying or canceling services based on political or religious beliefs.

Apparently, Chase Bank is bowing to some other ‘authority,’ and perhaps they refuse to cite a specific reason for the cancellation, ‘for legal reasons,’ is because they know they’re acting unlawfully.

Generational Punishment for Wrongthink

On top of closing the accounts of Rye and his wife, Rye also was told his young children will not be able to open accounts with Chase Bank.

‘It’s just hard to believe that your family, your wife, your kids can’t have a bank account because of the opinions of your employer and they’ve never done anything wrong. We all have completely clear records,’ Rye told Florida’s Voice.

In a voicemail reply, a Chase Bank representative told Rye the reason for closing his personal accounts and that of his wife could not be disclosed ‘for legal reasons.’ He was, however, told he could submit paperwork to have their accounts reconsidered. ‘We are going to try because you’re a good client of our institution,’ the representative said.”

Florida’s Anti-ESG Law

Debanking Dr. Mercola, his employees, and their family members for “wrongthink” is not only outrageous, but it’s also illegal.

Thanks to Anti-ESG legislation signed into law in May, financial institutions operating in the state of Florida are prohibited “from discriminating against customers for their religious, political, or social beliefs.”

Furthermore, the financial sector is banned from “considering so-called ‘Social Credit Scores’ in banking and lending practices that aim to prevent Floridians from obtaining loans, lines of credit, and bank accounts.”

Provisions of the new Florida statute, which took effect on July 1, 2023, will be enforced “to the fullest extent of the law” and banks that violate these provisions will be subject to sanctions and penalties. As Dr. Mercola noted, JPMorgan Chase Bank informed him of the account closures on July 13, 2023, after the new law was put into action.

JPMorgan Chase’s History of Debanking & Lawsuits

The flagrant discrimination Dr. Mercola and his associates experienced is not unique. In fact, 19 state attorneys general have put JPMorgan Chase & Co. (Chase) on notice for allegedly disenfranchising customers who hold religious, social, or political beliefs that are antithetical to the bank’s ‘woke’ ideology.

Despite Chase’s own public statements that, “No form of discrimination, harassment, inappropriate or abusive conduct is tolerated by or against employees, customers, vendors, contractors or any other individuals who conduct business with JPMorgan Chase,” attorneys general in 19 Republican states assert that the financial institution “de-banked a preeminent religious liberty organization. And this was not an anomaly, as there have been at least two other similar incidents.”

JPMorgan Chase is accused of cancelling, without explanation, the account of a religious nonprofit organization known as the National Committee for Religious Freedom. As a condition to reinstate the account, the bank then demanded a list of the nonprofit’s donors.

Additionally, the Missouri state treasurer’s office threatened to stop doing business with JPMorgan Chase after the bank’s WePay system denied payment processing for a conservative group known as the Defense of Liberty. The bank reversed course only after the public backlash brought on by the Missouri state treasurer.

The nation’s largest bank, JPMorgan Chase, is no stranger to lawsuits over its unethical and discriminatory practices. Since 2000, the financial institution has paid out nearly $39 billion in penalties.

In two of the bank’s largest payouts totaling more than $18 billion, JPMorgan Chase was accused of deceptively representing the quality of mortgage loans the institution sold, which significantly contributed to the 2008 financial crisis.

Perhaps the most stunning piece of evidence is the extensive 20-page chart put together by The Solari Report that documents selected legal, regulatory, and enforcement settlements of JPMorgan Chase between 2022-2019.

Countless lawsuits over the years have proven a pattern of deceptive and unethical practices by the largest banking institution in the United States, which is now weaponized against customers who hold beliefs that contradict the establishment narrative.

JPMorgan Chase’s Blatant Double Standard & Ties To Criminals

While JPMorgan Chase has repeatedly cancelled customers based on their religious, social and political beliefs, the financial giant gave criminals with political connections a pass.

Just last month, JPMorgan Chase reached a $290 million settlement with Jeffrey Epstein’s victims who accused the financial institution of not only turning a “blind eye” to Epstein’s activities but facilitating his child sex trafficking enterprise. The suit against JPMorgan Chase accused the bank of skirting federal laws while reaping the benefits of providing the convicted child predator financial services for years.

Despite the fact that JPMorgan Chase tracked suspicious transfers over nearly a decade between Epstein and his partner, Ghislaine Maxwell, amounting to over $30 million, the bank maintained ties with Jeffrey Epstein until just a few months before his death in 2019.

A separate lawsuit by the US Virgin Islands has revealed that the former CEO of JPMorgan Chase, Jes Staley, “had a close personal relationship with Epstein” and that the disgraced banker exchanged around 1,200 emails with the convicted pedophile. The suit alleges that the emails “even suggest that Staley may have been involved in Epstein’s sex-trafficking operation.” Staley has been accused by one victim of using “aggressive force in his sexual assault” of her and informing the victim “that he had Epstein’s permission to do what he wanted to her.”

Aside from JPMorgan Chase’s disturbing ties to Jeffrey Epstein, the corrupt bank also provided financial services for Hunter Biden and his associates. The House Oversight Committee recently subpoenaed four major financial institutions, including JPMorgan Chase, for records in relation to their investigation of the Bidens’ influence peddling scheme.

The nonprofit watchdog, Marco Polo, has released a trove of pictures and documents from Hunter Biden’s laptop, including five Suspicious Activity Reports from JPMorgan Chase, which indicate that the bank was fully aware of the criminal activity surrounding Hunter Biden and his associates. One Suspicious Activity Report flagged financial activity by Hunter Biden and his law firm, Owasco, for possible connections to human trafficking.

The Suspicious Activity Reports raised red flags on financial activity by Hunter Biden and his associates dating back to 2014, though Hunter Biden continued to maintain an account with the bank until 2017.

The troubling connections between JPMorgan Chase and criminals like Jeffrey Epstein illustrate a blatant double standard. While JPMorgan Chase has consistently targeted customers for their religious, social and political beliefs, the bank maintained questionable ties with known criminals.

Their End Game

The actions by JPMorgan Chase against Dr. Mercola and his associates follows a disturbing trend by all major financial institutions to cancel voices of dissent to the established narrative on a range of topics from Covid mRNA injections to election integrity, resembling the social credit system of Communist China.

Corrupt financial institutions are colluding with globalist organizations through public-private partnerships to transform society and initiate a Great Reset of the global financial system. Their end game is to install a worldwide system of social credit, digital IDs, CBDCs, and tokenized assets under the central banks and Bank for International Settlements, all of which are protected by immunities and shielded from accountability by the public.

As Dr. Mercola’s article stated, “That’s our future, unless we all refuse to play along. It’s crucial to reject CBDCs and to do everything in your power to not enter into that system. The life and freedom of your children and grandchildren depend on it. Your actions today will shape the future of your descendants, perhaps in perpetuity.”

Subscribe to Corey’s Digs so you don’t miss a Dig!